What’s Driving the Chip Shortage

Modern car manufacturing is more reliant than ever on semiconductors and when global supply chains are disrupted, the entire production process feels the impact.

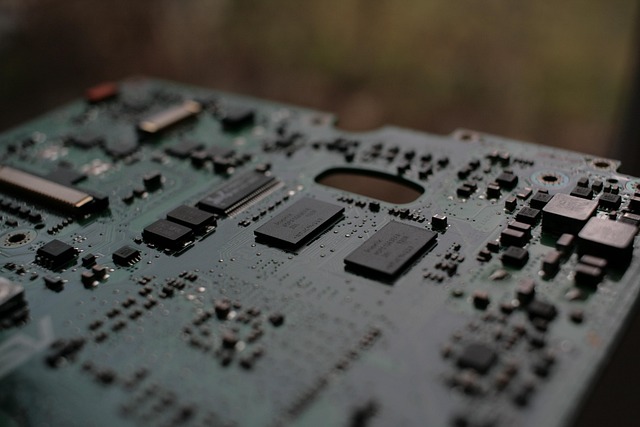

Why Semiconductors Are Crucial for Vehicles

Today’s vehicles are rolling computers. From advanced driver assistance systems to infotainment and safety features, chips power nearly every aspect of a modern car.

Key uses include:

Engine control units (ECUs)

Touchscreen interfaces and infotainment systems

Powertrain and fuel efficiency modules

Safety functions like airbags, ABS, and lane assist

Electric vehicle battery management systems

As vehicles get smarter, the demand for chips only increases.

How the Pandemic Triggered a Supply Chain Crisis

The COVID 19 pandemic upended manufacturing across multiple industries. Initially, auto manufacturers scaled back chip orders, anticipating lower demand.

But when consumer electronics surged during global lockdowns, chip producers prioritized those sectors. By the time car demand rebounded, automakers struggled to catch up.

What went wrong:

Early supply chain reductions in auto sector

Soaring demand for consumer tech (laptops, phones, etc.)

Limited chip production capacity to meet sudden spikes

This cascading effect hardened into a long term bottleneck.

Geopolitical Tensions and Trade Restrictions

Beyond the pandemic, international politics have added new layers of complexity. Battles over trade policy, national security, and regional dominance are disrupting chip manufacturing and distribution.

Major contributing factors:

U.S. China tech trade restrictions impacting chip availability

Export controls limiting access to advanced semiconductor equipment

Political instability in key supplier regions (including Taiwan)

Many automakers are now reconsidering their global sourcing strategies as a result.

The chip shortage is not simply a technical issue it’s a convergence of global forces reshaping the entire automotive supply chain.

Effects on Global Auto Manufacturing

The semiconductor shortage continues to send ripple effects through the global auto industry. From delayed assembly lines to escalating prices, manufacturers, dealerships, and consumers alike are feeling the strain. Here’s a breakdown of the most significant disruptions:

Widespread Production Halts

Many factories across North America, Europe, and Asia have faced temporary or extended shutdowns:

Lack of critical chips halts assembly lines for both electric and traditional vehicles

Automakers forced to idle operations at major plants to conserve parts for high priority models

Postponed Model Launches

New releases are no longer hitting the market on schedule:

Top automakers like Ford, Toyota, and Volkswagen have postponed major vehicle launches

Limited chip availability has slowed rollout of next gen tech features and EV advancements

Rising Costs and Scarcity

With inventory squeezed, manufacturers face a tough choice produce fewer cars or build more expensive ones:

Input costs have increased across the board due to supplier limitations

Both electric vehicles (EVs) and internal combustion engine (ICE) models have seen reduced production numbers

Consumer Prices Continue to Climb

The end result? A tighter market where buyers are paying more for less availability:

Dealerships have fewer models on hand, driving demand and prices up

Discounts and incentives have decreased industry wide

Popular trims and technology packages are harder to find or delayed

The disruption isn’t just short term; it’s beginning to reshape how the auto industry approaches production strategy moving forward.

Strain on Dealerships and Buyers

Walk into almost any dealership right now, and you’ll see more cars on posters than on the lot. New vehicle inventory is still scraping along historic lows, the result of supply chains that haven’t fully bounced back and chips that remain hard to come by. This isn’t just a small dip it’s a squeeze that’s rewriting how people buy cars.

Meanwhile, demand isn’t falling in line. In fact, high tech vehicles EVs, hybrids, anything with a smart dash are drawing more interest than ever. Buyers want features, connectivity, and fuel efficiency. But with limited supply, that demand is pushing up prices and stretching wait times.

The pressure’s also flipping the used market on its head. Pre owned vehicles that used to be a backup plan are now red hot commodities. Some are selling for what they cost new just a few years ago. For buyers, that means fewer deals. For sellers especially those with clean, well equipped models it’s a rare seller’s market.

Bottom line: whether you’re shopping new or used, expect to dig deeper and move faster. Inventory isn’t catching up anytime soon.

Strategies Automakers Are Using to Adapt

As the global chip shortage continues to squeeze supply chains and stall production, automakers are not sitting idle. They’re rapidly evolving their strategies to maintain output, protect profits, and streamline operations.

Simplifying Features to Reduce Chip Use

One immediate action has been trimming down vehicle features. Less critical digital systems like infotainment upgrades or advanced driver assist packages are being temporarily removed or delayed.

Some models are shipped without seat heaters, wireless charging, or touchscreens

Non essential tech packages are offered as post purchase installations when parts arrive

This approach helps get vehicles to market faster while conserving key components.

Building Direct Partnerships With Chipmakers

Traditional supply chains often relied on third party suppliers coordinating component orders. That’s changing.

Automakers are now partnering directly with semiconductor manufacturers

Agreements secure key chip allocations for future production cycles

Increased communication helps forecast demand more accurately

This shift reduces dependency on multi level suppliers and provides better long term stability.

Prioritizing High Demand and High Margin Models

To maximize limited resources, manufacturers are focusing on models that offer the greatest return.

Production is prioritized for popular SUVs, electric vehicles, and luxury models

Lower margin or niche offerings are delayed or scaled back

By focusing on what sells best, automakers preserve revenue streams even as output drops.

Investing in Vertical Integration

Many companies are now examining their entire supply chain and investing in vertical integration.

Greater control over key components reduces reliance on outsourced suppliers

Long term investments in in house chip design or manufacturing partnerships are increasing

Strategic acquisitions and partnerships are expanding internal capabilities

This long term play aims to create more resilient supply ecosystems capable of weathering future disruptions.

To dive deeper into how chip shortages are shaping the auto industry, read more here.

Long Term Industry Implications

The global chip shortage has forced automakers and suppliers to think beyond short term fixes. As disruptions continue, the industry is entering a phase marked by strategic, long range planning to build resilience against future shortages.

Leaner Inventory, Smarter Planning

Automakers are shifting from just in time inventory systems to more conservative stocking strategies. This shift may reduce efficiency in the short term but helps avoid catastrophic production delays moving forward.

Less reliance on real time inventory systems

Increased buffer stock of high demand semiconductor components

Better coordination between suppliers and factories

Rethinking Global Dependencies

The disruptions have pulled back the curtain on how over reliant the auto industry has become on certain chip producing regions.

Relocation of some manufacturing operations to diversify risk

Efforts to localize supply chains closer to final assembly plants

Strategic partnerships with a broader network of suppliers

Engineering for Efficiency

Manufacturers are now designing cars with chip efficiency in mind. By optimizing the technology stack inside vehicles, they can reduce total chip usage without making major sacrifices in performance.

Consolidation of electronic control units (ECUs)

Use of software updates to minimize hardware needs

Emphasis on flexible, upgradable digital architectures

Domestic Chip Production Gains Steam

Governments and manufacturers in the U.S. and Europe are pushing for expanded domestic semiconductor manufacturing to mitigate global supply risks.

Policy incentives and funding for chip plants (e.g., CHIPS Act in the U.S.)

Collaborations between governments and auto sector leaders

Aiming to stabilize local supply against future disruptions

Explore additional insights on chip shortage impact